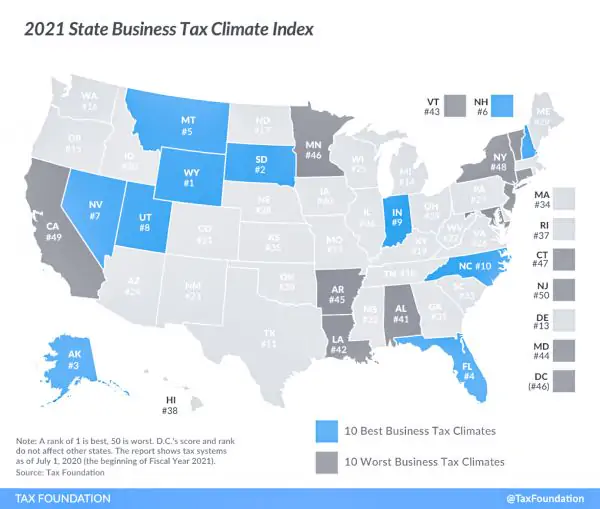

tax benefits of retiring in nevada

Nevada offers an abundance of tax advantages for relocating home and business owners alike including. For taxed items the sales tax rate sits at 46 plus local taxes which can reach a total of 8265 at the highest.

States That Don T Tax Retirement Income Personal Capital

Retiring in Reno Nevada gives you access to gambling as well as activities like skiing golfing or just hanging out on Lake Tahoe.

. Considering the national average is 100 retirement here is going to cost more than some other states. Thanks to all of the tax revenue flowing to the state from the casinos and tourism Nevada currently offers residents of the state a low overall tax burden compared to most states. However the amount of property taxes is not exceptionally high by most standards.

No corporate income tax. Up to 85 of benefits are taxable for couples whose combined. No tax on issuance of corporate shares.

Ad Find Everything You Need to Know About Saving Money for Your Retirement at AARP. The lack of income tax is a huge benefit but wait. 320189 SHARE OF POPULATION 65.

Contact an experienced CPA. No tax on issuance of corporate shares keeps more cash in your pocket. Due to these assets the state has the potential to offer some of the lowest tax rates within the United States.

The biggest benefit for retirees seeking a home in Nevada is perhaps the income-tax-friendly policies. For more information about the current Nevada real estate market contact Sierra Sothebys International Realty at 8884441505. The Younger You Are The More You Need AARP.

The Silver State doesnt tax pension incomes and any other income because it doesnt have an income tax. How Soon Can You Retire. 10 above the national average PER CAPITA INCOME FOR POPULATION.

Youll Likely Pay Less in Taxes. Ad Read this guide to learn ways to avoid running out of money in retirement. The state of Nevada does assess taxes on property.

People who live in Nevada typically pay more for groceries healthcare and transportation than the average consumer. The income of people that retire in Nevada is the tenth highest income for a senior citizen in the United States. Nevadans also dont pay sales tax on home sales food medicine and other items.

The seniors that reside in Nevada also have low poverty rates. 33238 TAX RATING FOR RETIREES. No personal income tax.

3 in its list of the most tax-friendly places to retire. Owning real estate in the state of Nevada is key factor when considering such tax advantages. No inventory tax keeps you from being taxed for temporarily holding inventory before it is purchased by your customers.

10 Pros And Cons Of Living In Nevada Right Now Dividends Diversify Retiring These States Won T Tax Your Distributions Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates Nevada Retirement Tax Friendliness Smartasset Retiring In These States Will Cost You More Money Vision Retirement Nevada Retirement Tax. No requirements of shareholders directors to live in Nevada. All of that savings adds up especially with home sales.

No requirements of shareholders. The property taxes assessed on an average-priced home in Nevada is 1423 per year according to Kiplinger which ranked Nevada No. No tax on sale or transfer of shares which keeps more cash in your pocket.

To learn more about the potential tax advantages of Nevada residency for yourself or your business visit httptaxstatenvus. In the top 10 of states according to data from NOAA. No gross receipts tax.

According to Sperlings Best Places the cost of living index in Nevada is 102. 194 COST OF LIVING FOR RETIREES. If you have a 500000 portfolio get this must-read guide by Fisher Investments.

Nevada also does not have a state income tax which is another benefit for senior citizens that reside in Las Vegas and are living on a budget. 24 minutes agoUp to 50 of benefits are taxable for married couples filing a joint return who have a combined income between 32000 and 44000.

10 Pros And Cons Of Living In Nevada Right Now Dividends Diversify

Is My Pension Subject To Michigan Income Tax Center For Financial Planning Inc

Nevada Retirement Tax Friendliness Smartasset

Moving Out Of State Don T Forget About The Source Tax Mullin Barens Sanford Financial

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

37 States That Don T Tax Social Security Benefits The Motley Fool

Nevada Tax Advantages And Benefits Retirebetternow Com

7 Countries That Offer Tax Breaks For Foreign Retirees

Happiest States For Seniors Hawaii And Arizona Top List

Nevada Tax Advantages And Benefits Retirebetternow Com

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog